Get the free form 720 vi

Show details

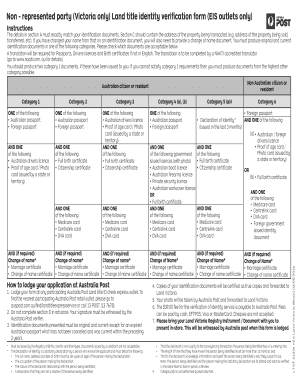

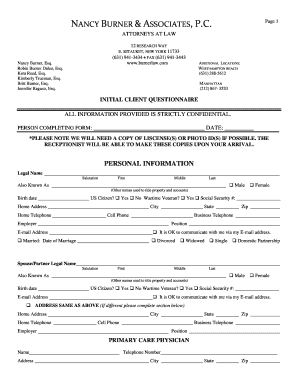

Print Form FORM 720 V. I. TIF REV. 10/2011 Gross Receipts Monthly Tax Return Government of the U. S. Virgin Islands BUREAU OF INTERNAL REVENUE Use for filing receipts of more than 120 000 per year. Telephone Number - Mailing Address PLEASE REMIT BY DUE DATE TO City State Zip Code ST. THOMAS U.S.V. I. 00802 ST. CROIX U.S.V. I. 00820 I DECLARE UNDER PENALTY OF PERJURY THAT THIS RETURN HAS BEEN EXAMINED BY ME AND TO THE BEST OF MY KNOWLEDGE AND BELI...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 720vi form

Edit your 720 vi form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 720 fillable form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 720 online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit irs form 720. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out usvi gross receipts tax form

How to fill out 720vi:

01

Start by gathering all the necessary information such as personal details, employment information, and financial details.

02

Carefully read the instructions and guidelines provided with the 720vi form to ensure that you understand the requirements and fill out the form accurately.

03

Begin by completing the personal information section, including your full name, address, contact information, and any other requested details.

04

Next, provide the required employment information, such as your occupation, employer's details, and any relevant income details.

05

Proceed to fill out the financial details section, which may include information about your assets, bank accounts, investments, and any other financial resources.

06

Double-check all the information you have entered to ensure its accuracy and completeness.

07

Finally, sign and date the form as required and submit it to the designated authority or follow any specific submission instructions mentioned in the guidelines.

Who needs 720vi:

01

Individuals or businesses who are tax residents in Spain and meet certain criteria may need to fill out form 720vi.

02

Form 720vi is particularly relevant for those who have assets or investments located outside of Spain, such as bank accounts or real estate, whose total value exceeds a certain threshold.

03

It is important to consult a tax advisor or the relevant tax authority to determine whether you are required to fill out form 720vi based on your specific circumstances and financial situation.

Fill

usvi excise tax

: Try Risk Free

People Also Ask about does your business need to file form 720

Can you file Form 720 electronically?

IRS is currently accepting electronically-filed Forms 720. Forms can be submitted online 24 hours per day.

What is Form 720 and when must it be filed?

Form 720 is a tax form required of businesses that deal with the sale of certain goods (like alcohol or gasoline) and services (for instance, tanning salons). These businesses are required to pay extra taxes, known as “Excise Taxes”, and they are accounted for through this form.

Where do I mail Form 720 V?

Addresses for Forms Beginning with the Number 7 Form Name (For a copy of a Form, Instruction, or Publication)Address to Mail Form to IRS:Form 720 Quarterly Federal Excise Tax ReturnDepartment of the Treasury Internal Revenue Service Ogden, UT 84201-000917 more rows • Nov 29, 2022

Who needs to fill out Form 720?

Businesses that are subject to excise tax generally must file a Form 720, Quarterly Federal Excise Tax Return to report the tax to the IRS. Many excise taxes go into trust funds for projects related to the taxed product or service, such as highway and airport improvements. Excise taxes are independent of income taxes.

What is a 720 quarterly federal excise tax return?

IRS Form 720, the Quarterly Federal Excise Tax Return, is a tax form for businesses that sell goods or services subject to excise tax to report and pay those taxes. IRS Form 720 consists of three parts, as well as Schedule A, Schedule T and Schedule C sections and a payment voucher (called Form 720-V).

What is the purpose of IRS Form 720?

Purpose of Form Use Form 720 and attachments to report your liability by IRS No. and pay the excise taxes listed on the form. If you report a liability on Part I or Part II, you may be eligible to use Schedule C to claim a credit.

Why is US Virgin Islands a tax haven?

The U.S. Virgin Islands uses a mirror system of taxation, also known as the “Mirror Code,” meaning that USVI taxpayers pay taxes to the Virgin Islands Bureau of Internal Revenue ("BIR") generally to the same extent as U.S. taxpayers would under the Code to the U.S. Internal Revenue Service.

Does your business need to file Form 720 Quarterly Federal Excise Tax Return?

If you own a business that deals in goods and services subject to excise tax, you must prepare a Form 720 quarterly to report the tax to the IRS.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify form 720 vi without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your form 720 vi into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How can I fill out form 720 vi on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your form 720 vi from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

How do I edit form 720 vi on an Android device?

You can make any changes to PDF files, like form 720 vi, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is 720vi?

720vi is a tax form used in the United States to report and pay the excise tax on certain types of health care plans under the Affordable Care Act.

Who is required to file 720vi?

Employers that offer applicable health care plans and are subject to the requirements of the Affordable Care Act are required to file Form 720vi.

How to fill out 720vi?

To fill out Form 720vi, taxpayers need to provide information about their health care plans, calculate the applicable taxes, and report on the form based on the IRS instructions.

What is the purpose of 720vi?

The purpose of Form 720vi is to report and pay the excise taxes associated with certain health care plans that do not meet the requirements established by the Affordable Care Act.

What information must be reported on 720vi?

Information that must be reported on Form 720vi includes the types of health care plans offered, the number of covered individuals, and the calculated excise tax due.

Fill out your form 720 vi online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 720 Vi is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.